Port Washington TID Case Study

The mayor of Port Washington brashly defended the economic benefits of his city’s data center development proposal. He passionately defended the construction jobs, the desperately needed economic development in an area with so little over the last few decades, and the long-term impact on the city’s finances.

In this article on the city’s web site, he leads with: “When you live near the water, you can sometimes see the storm clouds gathering in advance. And right now, clouds are looming over Port Washington’s economic future. The good news is that the storm hasn’t hit us yet. We still have the opportunity to chart a course to clear skies on the other side.”

And this: “This $8 billion-plus investment will create significant economic activity, tax revenue, infrastructure investment and jobs – all on a scale that works for a city our size.”

And this: “What is true: Vantage is paying for infrastructure upgrades that will benefit our entire city.”

And this: “Only by pursuing smart growth can we ensure that our city will remain vibrant and relevant for decades to come.”

So let’s see what the numbers say. After all, numbers don’t lie.

Background data on PW

Small size: 7 sq miles before annexation of data center parcels

Population (2023): 12,763

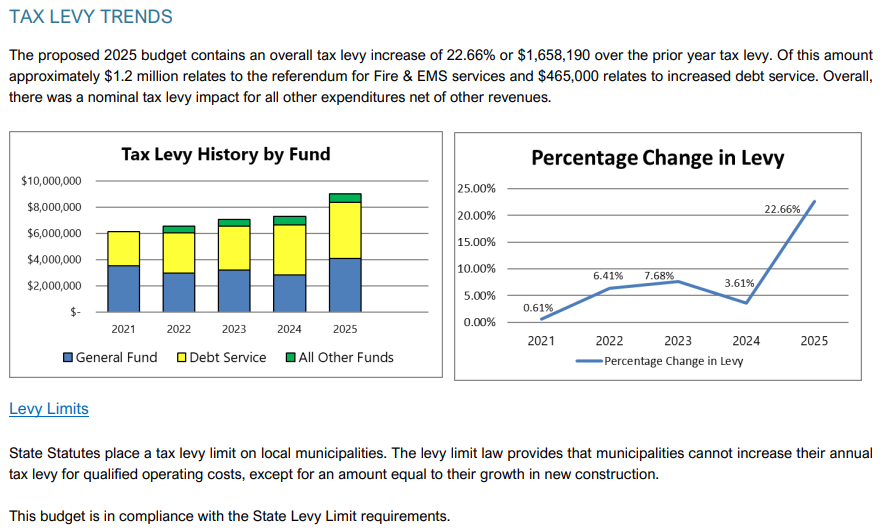

Tax levy (2025): $9M (tax levy is total of all property tax for the city)

The astute observer of the adjacent graphic will see a big increase from 2024 to 2025 for the tax levy. It has nothing to do with the data center, but there is another story line there that we will cover in another post. The topic will be state law dictating tax levy calculations.

Equalized value (2023): $1.59B (this is the total value of taxable real estate in PW)

City full time employees: 114

City administrative staff: 8

The TID Document

Magnitude

Every proposal for a tax increment district must have a document that looks like this one from Port Washington. Let’s dig in to the numbers and answer the question: good deal or bad deal for the residents?

Page 12: the TID covers newly annexed land that is 1,673 acres, or 2.6 square miles, a 37% increase in the city’s boundary.

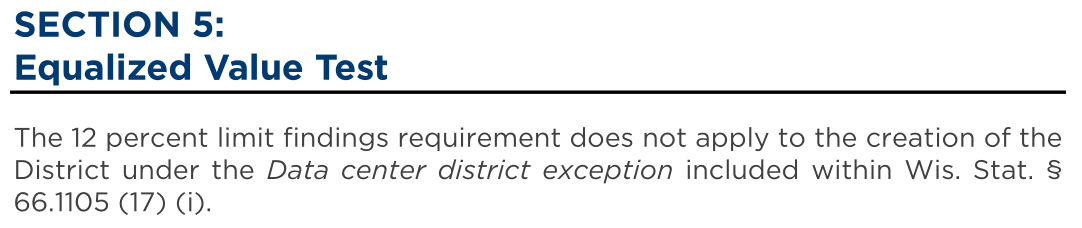

Page 15: If you’ve read the article in here about the 12% rule, you’ll know what the screenshot below means.

If not familiar with the 12% rule, that is a state rule that prohibits a municipality from having TIDs so big they make up more than 12% of the total real estate value in the community. This would have limited PW to a TID with a maximum forecasted new real estate valuation of $190M (12% of $1.59B), and that’s ignoring that they have other TIDs already (the 12% applies to all TIDs combined).

Page 22 shows projected valuation from the data center of $2.1B. That makes the data center 11 times bigger than what the law says would have been allowed. The law exists to prevent communities from putting all their eggs in one basket. Managing risk, you know, what your elected officials should be doing with your money. For more detail on the exemption to the 12% rule that allowed PW (and Beaver Dam) to proceed, see here.

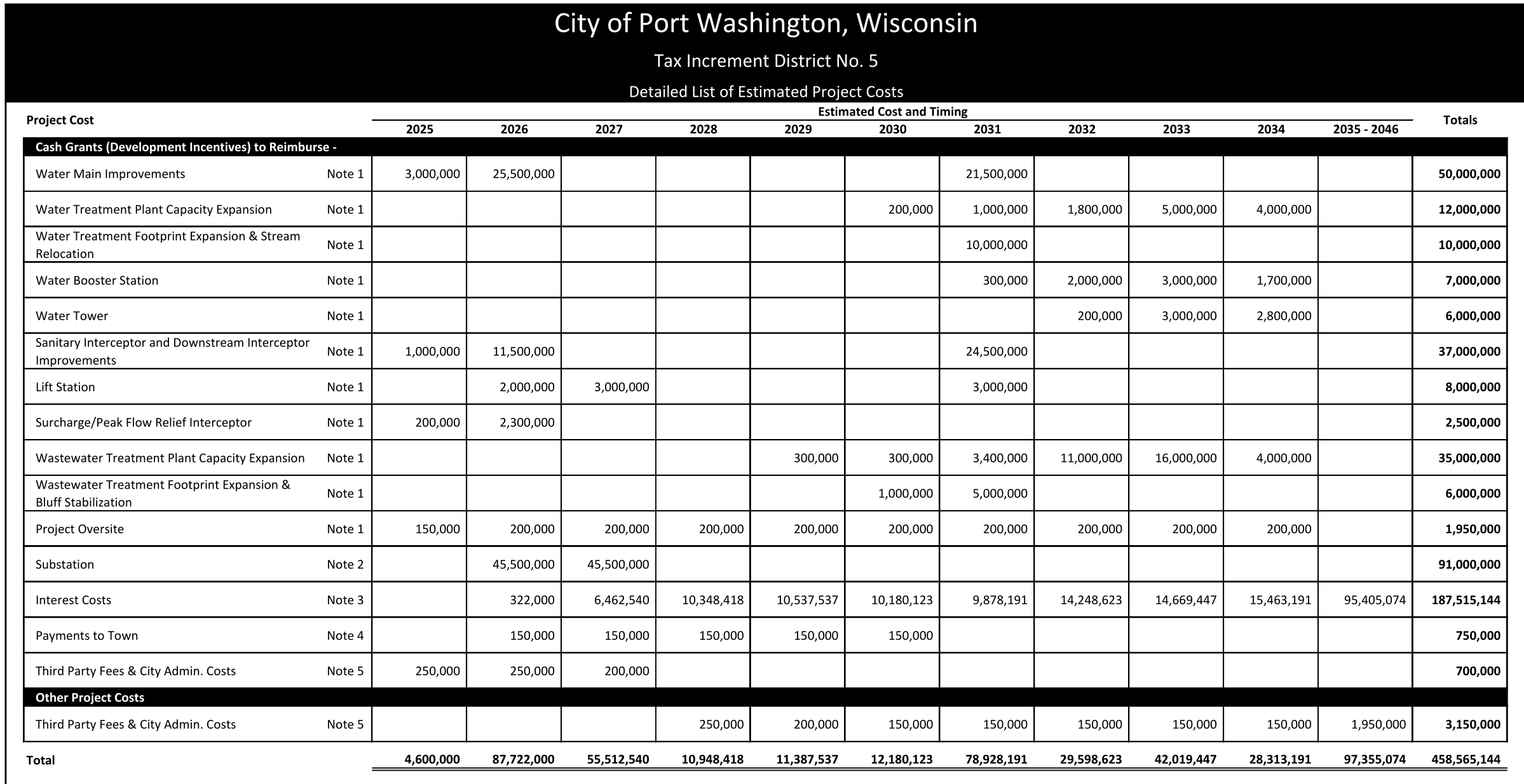

Besides the grand total being eye-watering, let’s stop for a second and do a critique of numbers on this page that are instant red flags: Third Party Fees & City Admin Costs. And remember, these estimates are provided by a professional firm that does TID proposals for a living.

These admin costs start at $250k/yr, mostly stay there for a few years, and then decline to $150k in the later years.

There is a case study right down the highway that is in the middle of their own data center TID that would have been a quick phone call or website click away to find actual data to inform these estimates! It’s called Mount Pleasant. Remember that whole Foxconn thing, then Microsoft swooped in to bail them out with a couple of monstrous data centers? Maybe that would be a good place to look to see what a solid estimate might be.

So what is Mount Pleasant’s project-specific admin expense over the last few years?

2023: $424K

2024: $425K

2025: $814K

So three problems, first the assumption that the costs would start at $250K, second that they would decline over time, and third the PW data center project is at least 3x as big as Mount Pleasant’s.

If they are underestimating this expense, the smallest one in the list, how much do you trust the other numbers?

Putting that one criticism aside, though, let’s get back to reality. The guys in suits (developer) have said “The tax revenue is gonna be awesome” but the city is staring at costs that they can’t afford. They can’t even borrow that much money. Say that again to yourself a few times because it’s important to why the TID is necessary:

No bank in the world is going to loan Port Washington $458M when its annual tax revenue is $9M. State law prohibits it too, btw.

Before we dive into how on earth PW will finance this infrastructure, we need to see the tax revenue side of this.

Project Costs

Now let’s get into the TID details. It starts with costs. Nobody, neither city nor developer, would go through all this trouble and formality if it weren’t for large costs.

Because of the size mismatch here — massive corporation with $8B project and tiny little city of $9M in annual tax revenue — this thing never gets off the ground if the developer expects the city to front any money for the massive infrastructure costs. So they start talking, and the first thing that they have to do is identify all the costs that the city expects to incur to support the project.

Page 20 shows the eye-watering results: $458M

Projected Tax Revenue

TIDs start the process of projecting tax revenue by laying out a development schedule. The development schedule identifies building count, size, and potential value. The next step after that is simple: multiply by the tax rate and you get your projected tax revenue by year.

So what does the Port Washington building schedule look like in the TID proposal? Page 22 of the proposal shows building square footage and estimated valuation:

By end of 2026, 1.5M sq ft, $568M in valuation

By end of 2027, another 1.5M sq ft, and another $568M in valuation

Nothing new in 2028 and 2029

Then in 2030, phase 2 produces 1.4M more sq ft and $488M in valuation

Then in 2031, phase 2 produces 1.4M sq ft and $488M in valuation

Total added valuation: $2.1B

Again, right down the highway is a case study that would have been worth studying. Microsoft’s Mount Pleasant first data center on the Foxconn site will be 3.5 - 4 years from start of project to operational. Somehow though, Port Washington’s partner companies will build 1.5M sq ft in a year. Then they’ll do it again the next year. Then they’ll rest for a couple years and do it over again for two consecutive years.

What’s the big deal if the proposal is a wee bit optimistic? Well, if it takes longer to build than the plan indicates, then it takes longer for tax revenue to show up. Overly optimistic building schedules result in overly optimistic tax revenue recognition forecasts which result in overly optimistic estimates of benefit timing to the city.

An overly aggressive building schedule would also be bad news for the construction industry and for its indirect economic benefit to the city. Far better for that indirect impact would be a steady 10-year construction schedule. Based on the current schedule in the proposal, construction will occur only in 2026, 2027, 2030, and 2031.

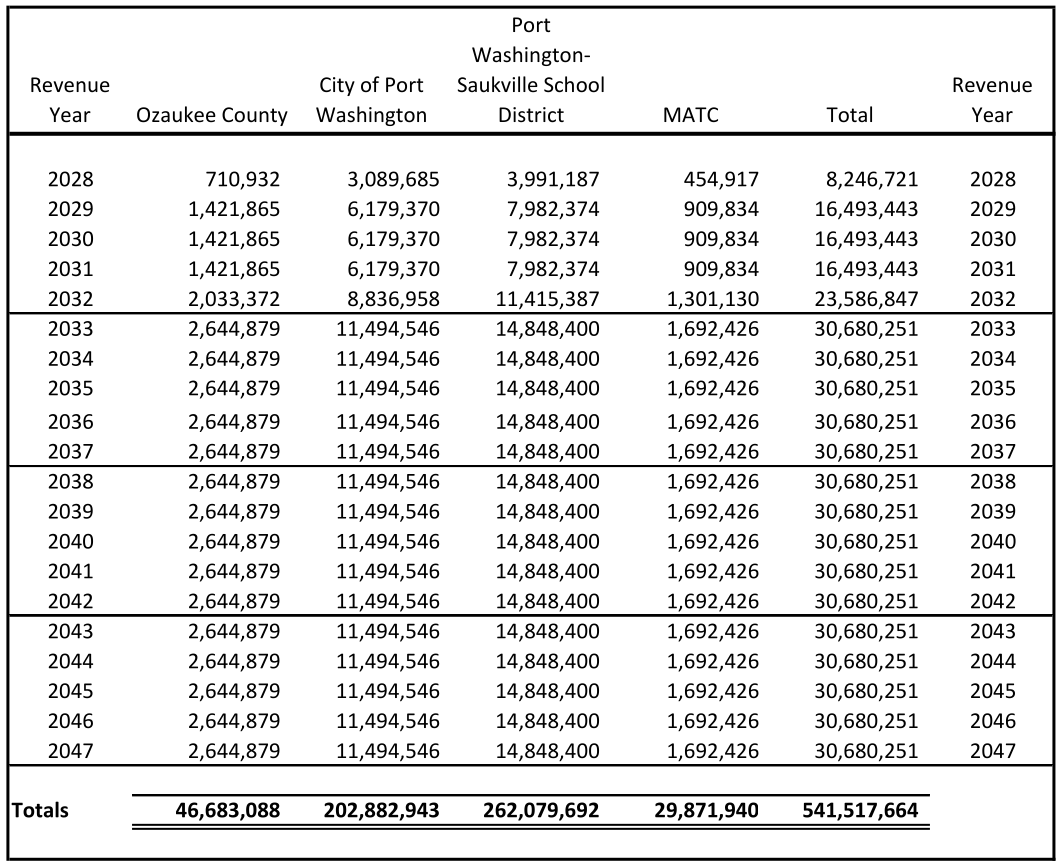

Page 23 of the proposal shows the new tax revenue by year based on the construction schedule. The first phase gets the tax revenue to $16.5M by 2027, where it stays until 2030/2031. Then phase 2 increases the tax revenue to an annual $30.6M where it stays through the end of the TID, currently set at 2045.

Back to TID mechanics

Remember the oversimplified TID explanation where the local government allows you to use your tax payments every year to help pay your mortgage? Well, it’s time to see how that plays out in a data center TID.

Recall that Port Washington has $458M in expenses for infrastructure and admin costs, far more than their ability to borrow. So what now? The answer from the proposal document verbatim:

Developer will provide the City with the necessary funds to construct the Public Improvements as identified in the Development Agreement. The Developer will also pay the costs of the City’s third-party consultants prior to the availability of tax increment, and the payments due from the City to the Town of Port Washington under the Town Agreement.

Super, the developer is paying for all of it! City gets its $16.5M in tax revenue growing to $30.6M and Port Washington is rolling in the dough… <insert sound of record album scratching>. Immediately after the above text in the proposal document is this:

The City will make development incentive payments to the Developer to reimburse it for:

All costs related to … public improvement

All payments to the city … for legal services, engineering services, etc

All payments made to the city to satisfy city obligations pursuant to the Town Agreement

All costs related to substation and transmission lines

In other words, cutting through all the words, “the developer agrees to pay for everything and the city agrees to pay them back for everything.” Port Washington is even agreeing to pay the developer’s loan interest at 7% for the life of the loan. And interest on $458M isn’t cheap. Over the life of the TID, that is $187M.

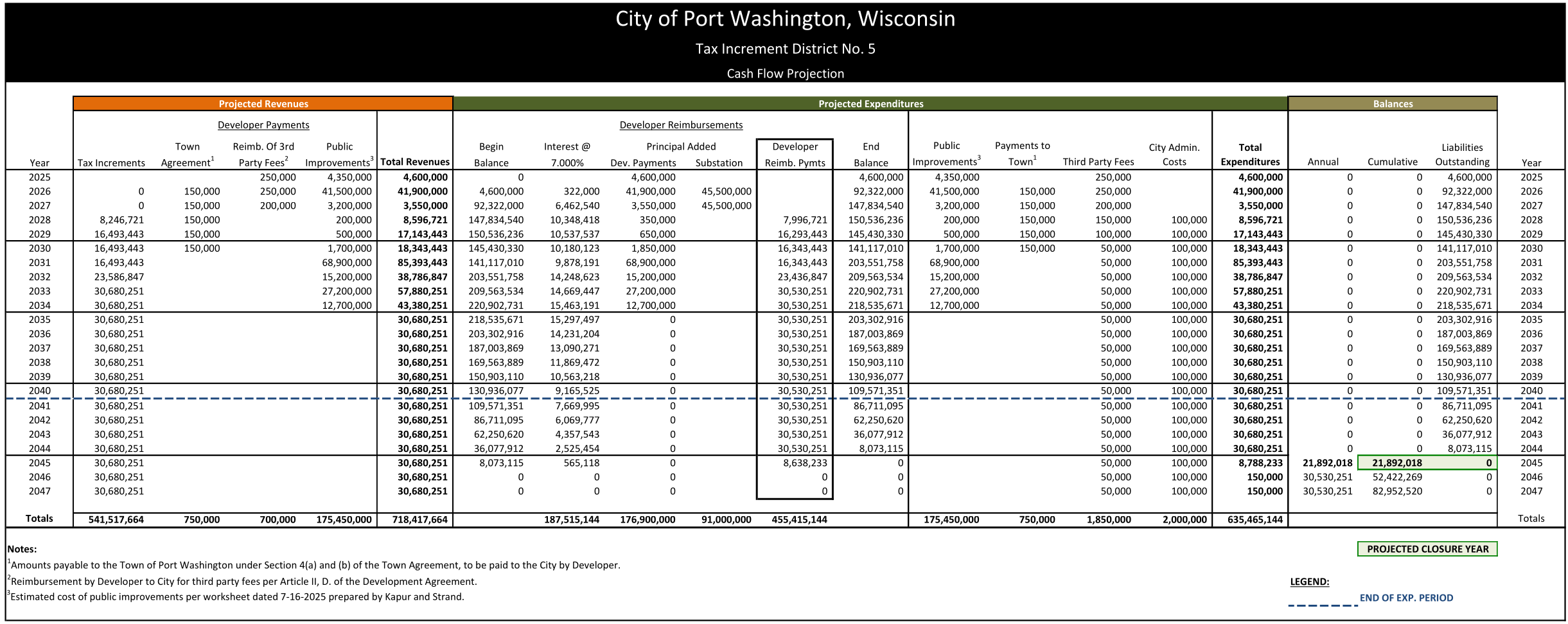

But wait, how will the City pay them back all $458M. The city’s tax revenue is a measly $9M and it’s all accounted for. And that’s where the TID magic happens: the city is agreeing to let the developer use their future tax payments to reimburse themselves for the $458M. So that $16.5M turning into $30.6M will go from developer to city and immediately back to developer every year until the $458M is paid off. And when does the proposal forecast that the $458M will be paid off? Again quoting from the document (page 25):

The District is projected to accumulate sufficient funds by the year 2045 to pay off all Project cost liabilities and obligations.

The document does note, however, that the projected closure of the TID (when all the obligations are paid) can vary based on timing and amount of expense and tax revenue. So YMMV. Just don’t expect it to vary for the better.

Put all that revenue and expense together in a cash flow spreadsheet and you get the “money page.” It’s page 26 in the proposal and shown below.

That’s a really busy graphic, but the orange header is revenue that the city receives each year. The green header is the expenses the city pays on the project, and the last 3 columns are the running balance of liabilities. The TID can close when those liabilities reach $0. When the TID closes, all future tax payments then go to the various tax authorities for use in their general funds. Put very bluntly, it’s when the TID closes that the city see its first dime of usable tax revenue.

And here is where this proposal fails the most simple of tests: in the happiest of happy path plans, the city of Port Washington gets no usable tax revenue from this project until 2045. And we’ve already identified two problems that will make it take even longer and cost more:

The proposal underestimates the city’s cost of managing this project

The proposal’s construction schedule is insanely optimistic

Both of those would push out even further the first dime of revenue date.

Then why vote yes?

To answer that question, let’s go to the very last page of the proposal, page 32.

If everything goes according to plan, buildings all built, expenses in line with forecast, valuation forecasts were accurate, the annual tax revenue forecasted for Port Washington starting at TID closure in 2046 is $11.5M, and $14.8M for the school district. If Port Washington’s expenses grow at 3% per year until 2046, the city’s budget will be $21M. The prospect of getting 55% of your budget funded by a single taxpayer, and one that doesn’t even require a lot of public services seems worth the bet, no?

The terms of the agreement also protect the city from the developer walking away and leaving the city with debt to pay. All the debt is the obligation of the developer whether they build or not. The city will get a bunch of infrastructure built that others can ride, like water/sewer and electricity, maybe some roads. The construction jobs will stimulate the economy. The permanent jobs will be high-paying and stimulate the economy.

Back to reality

What looks too good to be true probably is.

The permanent job total at full buildout is weak (200-300) given the size of the parcel (1200 acres)

The construction schedule is unrealistic

The city’s costs are underestimated

Data centers don’t attract other commerce

No one wants to live near a data center

The best case scenario doesn’t produce a dime of revenue to the city or the school district until 2046

The developer isn’t committed to any minimum build

And the reality that no one can run away from and that Port Washington officials and others don’t seem to understand:

Technology relentlessly reinvents itself, casting aside yesterday’s technology without care

The historical average lifespan of a data center is 15-25 years, so if Port Washington is lucky, the massive largesse of tax revenue will last a few years before they inherit empty 1200 acre, 6 million square foot data center campus that can’t find a tenant.

Conclusion

Information imbalances always spell doom for the party with too little information. Port Washington appears to have not understood the technology business and to have been smitten by promises of massive future pots of gold. There are no significant long-term employment or indirect economic benefits. They get nothing but low odds of success and gave everything to the developer. They annexed and rezoned 1200 acres of property that likely had more productive and long-term viable uses. And even if it succeeds, there might not be more than a few years of benefits to the residents before the data centers reach obsolescence.

And why does he still defend the plan? To use the mayor’s own words: because he thinks “clouds are looming over Port Washington’s economic future.” Instead of charting a slow-and-steady course with residents safely in tow, he’s betting the city’s future on a single risky project, telling the residents he knows what is best for them. If only they could see the storm clouds he sees.

His plan will distract his city for years to come, preventing them from focusing on other more boring initiatives that actually provide incremental benefit. And taxpayers will have to bear the cost of any unexpected interim costs associated with the distraction that is the data center project.

The ribbon cutting ceremony should be a lot of fun, though.