Jan 6, 2026 update:

A resident publicly presents this problem to the city council, and Mayor Dark Clouds admits the problem exists. He is saying that they went into the deal knowing that state law prevents the city from getting tax levy increases without burdening existing taxpayers for the next 20 years. That is a stunning display of irresponsibility. Without that state law change, this multi-billionaire deal in his city will be useless to the city.

Just take the ‘L’ already.

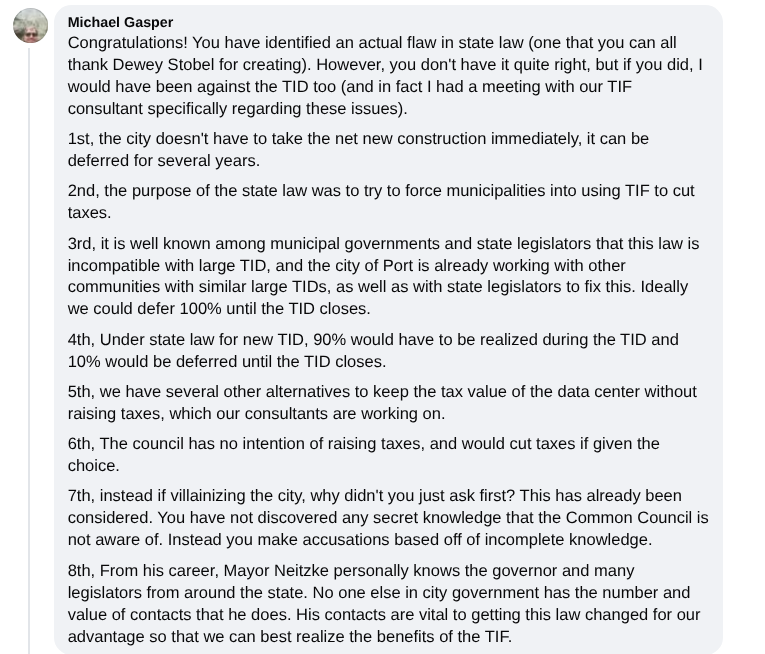

An interesting exchange between a Port Washington resident and city council member took place on social media recently. A resident articulated that the city was stuck between a rock and a hard place financially with its data center deal, with state law constraining the city from doing what it said it was going to do. Trying to simplify a bit:

City needs to raise its tax levy (all property taxes combined) to support needed services

City can only do that with new construction (per state law)

City does data center deal to get new construction

State law says use it or lose it when it occurs (take it year 1, or over 2 years, or over 5, slightly different rules for each, but no more than over 5)

Data center TID doesn’t close until 2045. Data center taxpayer doesn’t contribute to any levy increase until TID closes.

Rock: if city raises tax levy when new construction occurs, current residents will see increased tax bills because of the data center project, a tough pill to swallow for residents.

Hard place: if the city doesn’t raise the tax levy as the construction occurs, they can’t solve the problem they claim to have set out to solve: tax revenues aren’t growing fast enough.

Then an actual city council member responded. The problem is state law, you see.

Start with 1) and 6): “We can defer it for several years” but “we’re not going to raise taxes.” Yes, you can defer for 5 years per state law, but if in year 1 the new construction allows a 34% levy increase and the residents bear all the burden of that increase, will those residents be happy with 14-5-5-5-5 vs 34-0-0-0-0? Not to mention the plan shows the construction finishing in 4 different years all early in the TID schedule so spreading it over 5 years starts to step all over itself.

And if per 6) you aren’t going to take the increases to avoid the tax burden on the current residents, it doesn’t matter how much you can spread it.

In 3) he admits they knew of the problem, that other communities doing these massive data centers know of the problem, and that hope is their strategy for fixing it. “Ideally we could defer 100% until the TID closes.” While ideal for current taxpayers, that would mean there is no general fund benefit to the city until 2045 on a problem the mayor has described as critical now. One other community with a fancy new data center just decided to jack up their general fund tax levy in 2026 thanks to their first building going on the tax rolls, so clearly the solutions to the problem are at hand.

In 5) he says they have other alternatives the consultants are working on. That’s right, they approved the deal knowing these problems existed and after approval are trying to find creative solutions. They called a Hail Mary play and told you it was a slam dunk, to mix sports metaphors.

In 7) the theme of peasants questioning the royalty reappears, seemingly quite common in PW. Man posts thoughts on social media, but I guess he should have called the open, transparent toll-free PW city council number instead. Let’s not arouse the little people with concerns, ok?

8) might be the best though. Yes we knew these problems existed. No we don’t have a solution yet. Yes we’re spending your money working on them. BUT THE MAYOR KNOWS PEOPLE! ALL HAIL THE MAYOR!

Later in the thread, the original poster also identifies a side effect of the scenario that further harms PW: all that new construction added to the tax rolls makes growth even harder than it is today. Yes, it takes 2x as much growth when the base you’re trying to grow is now 2x bigger. So if you can’t grow fast enough today, why would you compound that problem with a 2x bigger base?

This is what irresponsible city management looks like.