Does data center development lower my taxes?

Let’s look at what just happened in Mount Pleasant, WI and see how the taxpayers are doing.

Some terms so you don’t get lost:

Tax levy — the total amount of property tax dollars collected by the village

General fund — the village’s checkbook where all the normal operating expenses go: police, fire, etc.

Tax rate — the percentage of your property’s valuation that you pay

In 2025, Mount Pleasant added almost $1B in new valuation from completed Microsoft development, representing a 17% increase in valuation for the village. That is a massive 1-year increase. State law allows the village to increase its tax levy by 17% when that hits the tax rolls. Or they can spread it out over 5 years.

Because the Microsoft development is in a TID, the village has a problem. If the village raises taxes, Microsoft won’t contribute to them. Their tax dollars are only allowed to pay for costs in that TID, inclusive of “developer incentives” which translate to paying themselves through tax credits. So 100% of the tax increase that is allowed by state law has to be funded by existing taxpayers. If Microsoft was contributing to the general fund tax levy then a 17% increase would result in no increase for regular taxpayers because Microsoft’s tax payments would cover the delta. Better still, the village could raise taxes 10% and everyone’s taxes would drop because Microsoft would contribute 17% and the levy was only rising 10%. (Your algebra teacher wasn’t wrong when he or she told you that math would come in handy one day.)

So, what did Mount Pleasant do…?

The temptation is too strong

Budgets are hard. Needs always exceed finite dollars available. Then along comes new construction that is in a TID.

“We have this 17%… can’t we increase just a little? We could get that new system, hire that new person, upgrade those new computers….”

“We told everyone all this development would lower taxes, or that it would at least cap the increase. And if we raise the levy it’s the current taxpayers who bear the increase. They’ll get mad at us.”

“Well, it’s sort of use it or lose it, so c’mon, just a little.”

“Oooohhh, wait, look at this…”

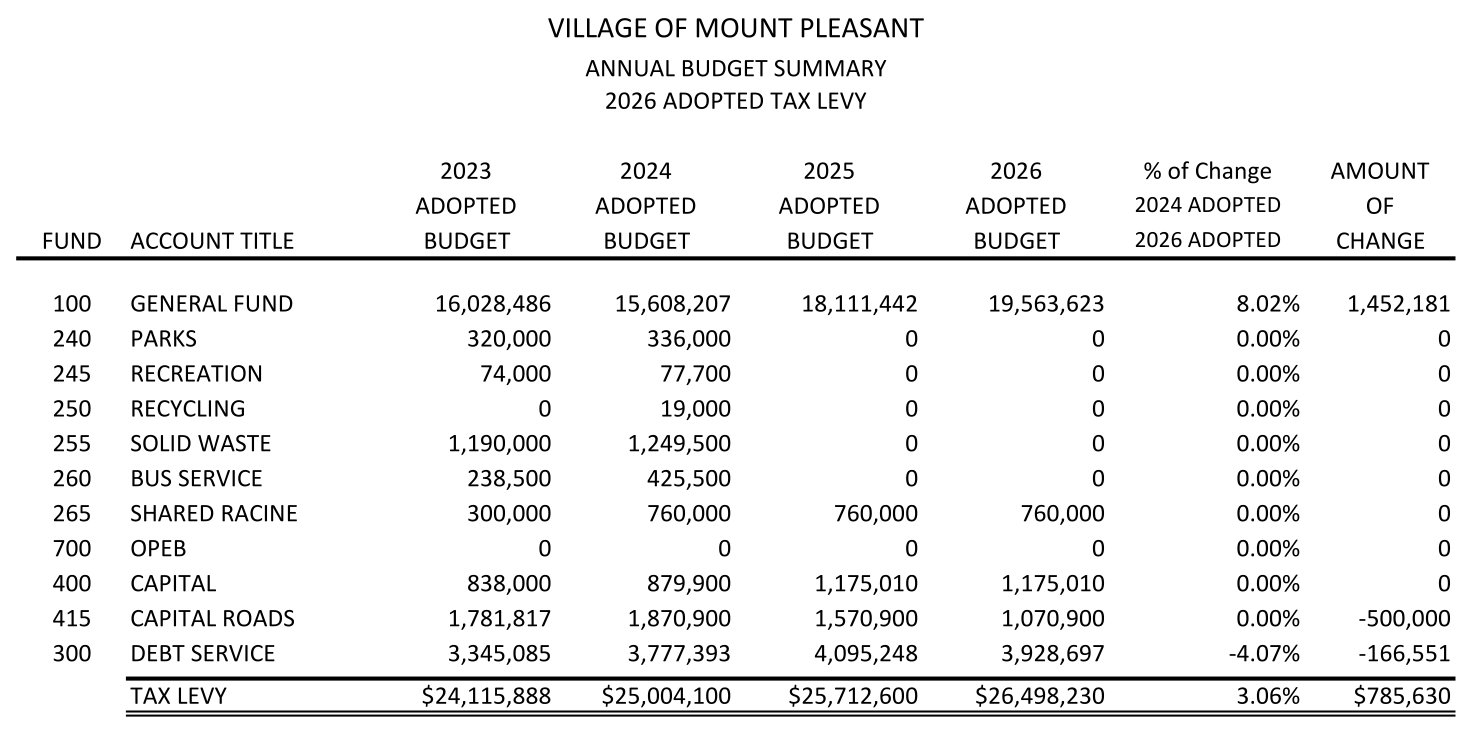

The final budget presented showed a 3% increase in the total budget,

but …

Look more closely

The general fund tax levy rose 8%. A convenient $500k reduction in road capital expense and a $166k reduction in debt service masks the 8% increase. When residents get their bills they will see a 3% increase, not the full 8%. Then in subsequent years when road expense or debt service rise again, the increase can be blamed on those expenses rising. No one will think to remember the opportunistic increase in general fund expenses in 2026.

Did they do this knowingly? Did they artificially lower the road capital expense to purposely hide the 8% increase? Nobody knows, but state law not only allows it but encourages it. New construction creates new valuation. New valuation is the main driver for tax levy increases. When the construction is in a TID, the increase in taxes happen even though the TID property owner doesn’t contribute to the increase. Current residents get to pay more until the TID closes up to 20 years in the future.

In the Mount Pleasant example, ironically if it weren’t for the Microsoft new construction, residents’ tax bills would have decreased from 2025 to 2026. Instead they are rising 3%.

Read that last sentence again. Read it until the light bulbs go off.

If you live in Port Washington, you will now understand why the terms of your data center deal are so bad. It doesn’t matter how bad the terms are. It’s not the terms of the deal that matter. It’s not the jobs. It’s not the infrastructure build. It’s the net new construction. That’s it. That’s all they are chasing. So they can raise your taxes. Chasing construction at any cost so they can raise the levy because that’s what state law incentivizes.