Does Mayor Marck miss the mark when she says about her beloved data center project:

“What that means is we’ll have 15 percent of a budget that we can use to fund fire trucks and police dogs, all those things that we need without raising property taxes a penny”

Well, numbers don’t lie, so let’s look.

Implied in the mayor’s comments is that the Beaver Dam budget will be higher by 15% because of the arrival of the data center project. To start with, that implies she’s not intending to push for a reduction in your taxes from the data center, so if she’s said that somewhere else, she’s talking out of both sides of her mouth. But putting that aside…

She has some constraints from state law that are going to make things tough.

First, a tiny bit of background on how tax levies (all the property taxes combined) are calculated by state law. (Here’s where I’ll remind you that your grade school teacher was right about needing math later in life.)

Step 1: calculate next year’s debt payments. Call that number A.

Step 2: calculate all the new construction in the city during the past year — new buildings, new garages, new house additions, new houses, anything that added taxable value. Call that number B.

Step 3: go get last year’s total taxable property value for the city. Call that number C.

Then calculate this: A + (A * (B / C)). The result is the maximum the city’s tax levy can be in the coming year.

In English, it means the city can only raise tax by the percentage of net new construction. That term “net new construction” will be referred to from here as NNC.

If that doesn’t make sense, go back to the top and read it again until it does. It’s important to understanding the rest of this.

(Minimum required knowledge from this section: a city has to build stuff if they want to increase the budget)

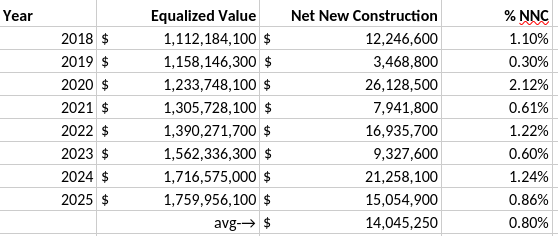

And here is how Beaver Dam has been doing on that number for the last 8 year. They aren’t beating inflation. They aren’t even close. 0.8% is pretty bad compared to the rest of the state as well.

So what, you ask? At least my taxes won’t go up! And yes you are right, but the village’s costs rise every year even if no new services are added. Cops need raises. Firefighters need new equipment. Etc.

If you were still making the average salary in the year 1980, you’d be making $7/hour and nowhere near able to afford a decent lifestyle today. So same principle with the city. If the city isn’t keeping pace with inflation, bad things happen over the long haul.

(This is why your local officials are “chasing” development. But that’s another thread.)

Back to the mayor’s promise: cute new police dogs without raising taxes!

She obviously means raising your taxes. Cute police dogs do cost money, so she has to be saying she can raise city total taxes, but since you have a deep pocketed tech company in town, they’ll be pitching in on the budget and she can raise total taxes without raising your individual taxes. Seems to make sense, right?

Well hold on there big fella, you didn’t think state law was that straightforward didja?

I’m sorry I keep talking about TIDs in here, but I must. My latest super brief definition of a TID is this:

you need a new roof, costing $10K

you pay $2k in city taxes every year

govt agrees to let you skip 6 years of tax payments to pay for the roof (5x$2k + another year’s taxes to cover the interest!)

Yeah, they won’t do that for you so don’t bother asking. But if you swap “new roof” for “new data center” you have a TID. Oh, and swap $10K for $110M (M as in million) cuz you’re going big time on this one.

And here is the mayor’s first problem, WHICH SHE SHOULD KNOW SHE HAS:

A city has to raise the total tax levy when the new construction hits the tax rolls.

coupled with …

The developer in a TID does not contribute to the city’s tax revenue general fund until the TID closes (which for BD is currently scheduled as 2045).

So now Mayor Miss-the-Marck has a problem. She wants new dogs. She needs more money to buy them. She said your individual taxes wouldn’t rise.

If she raises taxes before 2045, she can get the dogs but your individual taxes will rise

If she waits until 2045 for the dogs, she will have missed the opportunity to raise your taxes

Now for the REAL problem

Grab some coffee, or beer. We’re going to dive into this spreadsheet and show what will happen and show how the mayor really messes things up with this project.

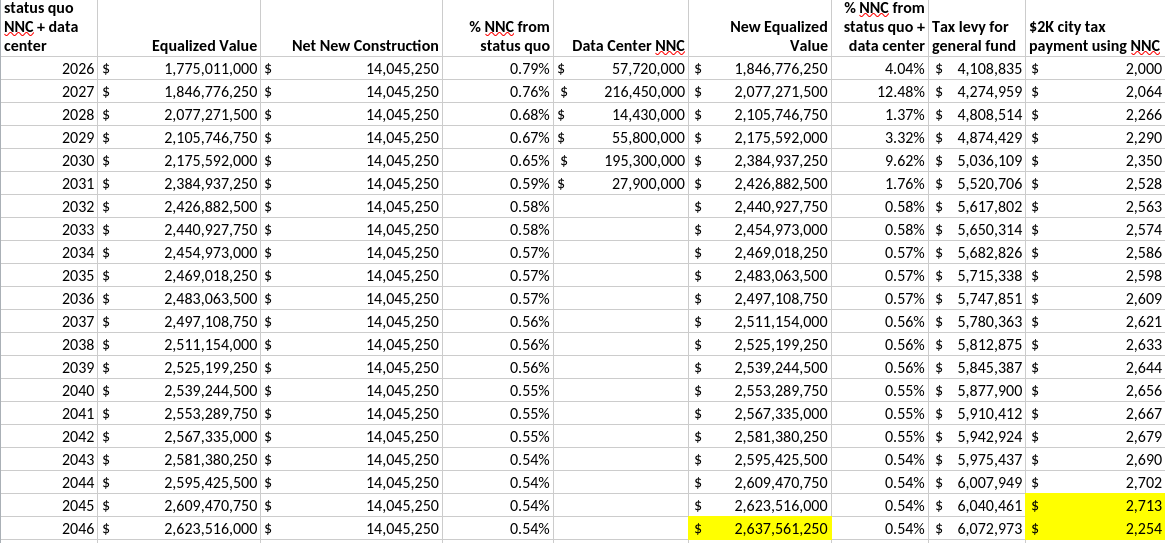

Column 1 is the year — that’s easy, right?

Equalized value is the sum total of all property values in BD

Net new construction is the average new construction in BD every year before the data center. The spreadsheet assumes that keeps happening.

The data center NNC column is the value of the new buildings as they get built.

So let’s stop right there for a second. Remember I said above that the mayor has to raise taxes when the new construction hits the tax rolls. Use it or lose it. So if the mayor wants more total tax, she has to raise taxes in the years with Data Center NNC numbers.

New equalized value is equalized value + net new construction + data center NNC. That number will form the basis of the next year’s tax levy and your individual tax bill.

% NNC from status quo + data center is the % increase in your tax bill

$2K city tax payment… is an example of what happens to a $2000 tax bill in year 2026 all the way to TID closure in 2045.

Two things to notice, highlighted in the bottom right corner. Your $2K tax bill rose to $2713 in 2045, and then when the TID closes it drops to $2254 because that’s when the data center owner starts contributing to taxes. Note that it dropped to a number still higher than where it started. And note that you paid much higher taxes for 20 years before the data center operator showed up to start helping out.

That other yellow-highlighted number is about to get really important. Keep reading. We’re not done yet!

Now for the real big giant unsolvable problem. But let’s start with a recap just in case I’ve lost you.

You have to build stuff if you want to raise the tax levy.

Beaver Dam doesn’t build a lot of stuff historically. Inflation is winning!

A data center campus is a lot of building stuff. Yay.

Mayor wants to buy more dogs, needs more tax revenue.

State law says you can raise taxes when the new construction hits the tax rolls. Use it or lose it. It’s for dogs, so we’re using it.

Data center owner doesn’t contribute to increased taxes until 2046 on current plan.

Beaver Dammers get to pay for any tax increases while the data center TID thing is open (through 2045). But we’re getting more dogs, and we love dogs, so it’s cool.

Then in 2046, the data center operator starts paying taxes and our taxes go down (yay) ... to a level higher than they are today (boo).

Still with me? If not, reread until etched in your brain and you are ready to recite it at the neighborhood bar.

Now it’s 2046, we have a much higher budget, about $1.9M higher. Of course, taxes are quite a bit higher, but remember, it was for dogs, and dogs are awesome. But the real big unsolvable problem now rears its ugly head.

It’s time to grow again!

Remember the $14M per year in new construction that BD produces every year on average? Let’s assume in 2046 BD can still crank that number out every year. Well, unfortunately, it was already a small percentage of the total valuation (see #1 above). But now we’ve added this monstrous data center thing to the books, which we were excited about because we could raise taxes (on existing residents only, but never mind that). The data center now, instead of being awesome is a big giant boat anchor on growth. The $14M is only 0.5% of new much larger total valuation ($2.6B, that other yellow-highlighted number above) thanks to those big giant data centers the mayor is bragging about. If inflation runs at 2.5%, then you fall behind 2% every year. Keep doing that for 19 years and 100% of your added $1.9M tax revenue will be wiped away by inflation. A few years of high inflation and bye-bye $1.9M in really short order.

Guess how much new construction BD will need to keep pace with 2.5% inflation in 2046 with all that data center construction? $66M … every year … and growing a little bit more every year thereafter. Sounds like a stretch. And even if they pulled it off, BD would look like a parking lot.

The real root cause of this problem is the absence of any real economic impact of the data centers. If the data centers employed a lot of people, you’d get new businesses and their new construction. You’d have those new people updating existing homes and driving increased value. Ya know, all the stuff we used to give tax breaks for.

Instead, you bought a boat anchor and your job now is to run faster with it attached than you were previously running.

Moral of the story: the worst thing you can have in a small town in Wisconsin (besides a lot of Illinois tourists) is a huge valuation for something that produces little to no economic development.

So did the mayor miss the mark? Why yes, yes she did, and by quite a lot. And she didn’t just not fix the problem. She exacerbated it.

If somehow the mayor has a plan to make this the first data center ever to produce large employment numbers and direct and economic development post-construction, I shall personally buy the next dog for the city. And I will apologize publicly to the mayor.